Startling Facts: Why Trading Indicators Software Transforms Financial Market Outcomes

“Over 80% of successful retail traders rely on advanced trading indicators software to give them an edge in volatile markets.” – Market Data Insights

The financial market is ruled by lightning-fast changes, and information is everything. With so many variables at play—such as price action, time frames, and market data—an effective trading system must process and interpret vast amounts of data in an instant. This is where trading indicators software comes in, transforming how traders analyze technical indicators and execute trade ideas. From automated market scans and in-depth technical analysis tools to real-time trading charts and custom indicator development, these platforms equip traders with actionable analytics, not just raw numbers.

More than just pretty charting platforms, these advanced analysis tools convert data into clear signals, letting users track trends, compare strategies, and refine approaches with confidence. Whether you’re trading direct in live markets or paper trading to test new trading strategies, choosing robust analysis tools can drastically reduce your risk of losing money and amplify your potential for success. Today’s most reliable trading chart solutions even offer backtests on historical data and seamless integration with platforms like Interactive Brokers, ensuring you never miss a market-moving opportunity.

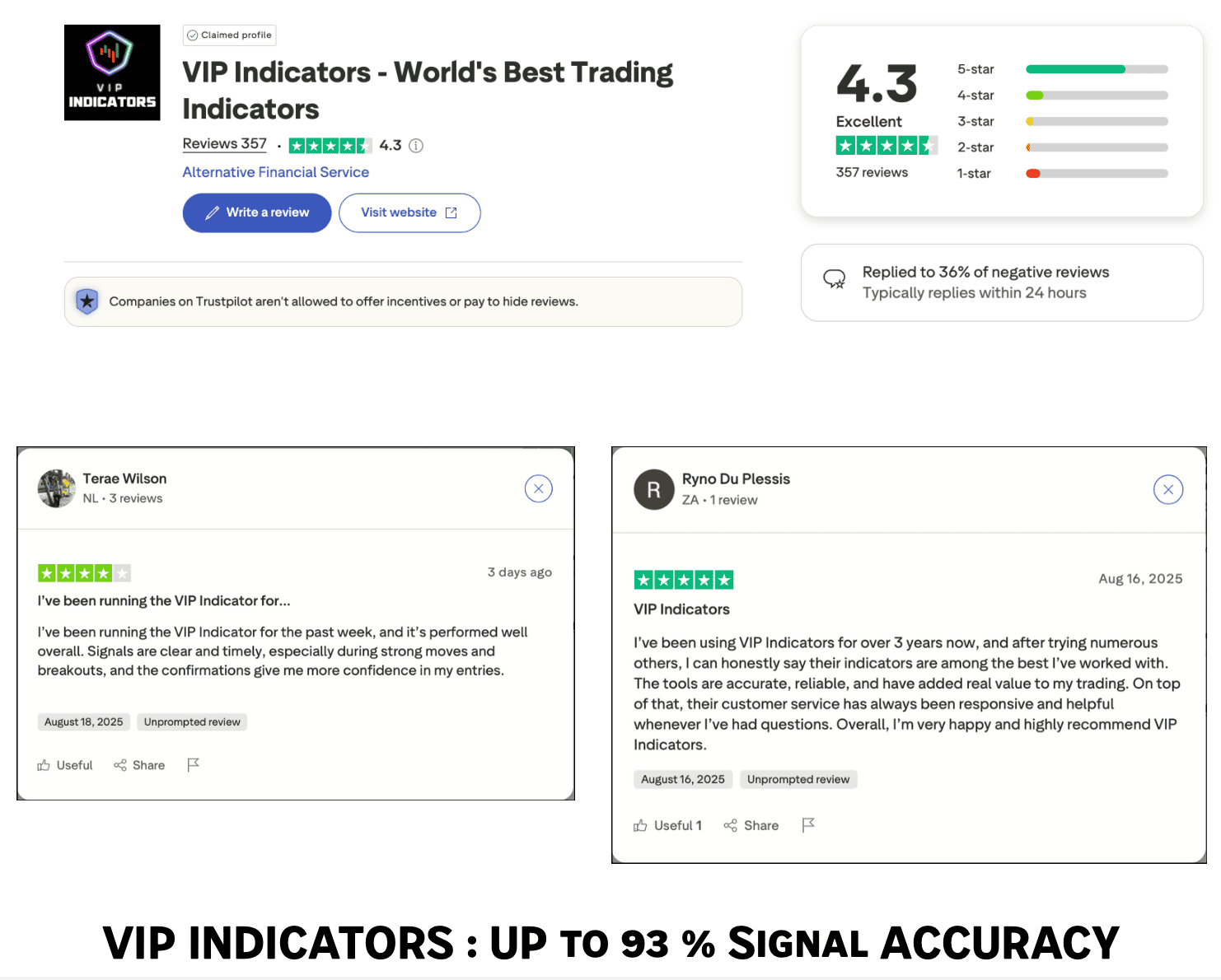

ADVERTISEMENT SECTION : VIP INDICATOR

What You’ll Learn From This Guide to Trading Indicators Software

- Understand the core features of trading indicators software

- Discover which technical analysis tools are best for your trading style

- Learn to build custom indicators for actionable trade ideas

- Explore real-world trading charts and analysis tools for better decision-making

- Master integrating technical analysis and market data to boost profitability

Defining Trading Indicators Software and Its Role in Technical Analysis

Trading indicators software forms the backbone of modern technical analysis, blending analysis tools, market data, and sophisticated charting platforms into one powerful trading solution. At a basic level, these solutions interpret complex financial market data to highlight trade opportunities and signal possible market reversals or breakouts. But as markets evolve, top-performing trading systems must offer more than price charts—they need to support custom indicators, in-depth market scans, and seamless visualization tools.

Robust technical analysis tools empower users to track a wide array of market indicators—moving averages, RSI, MACD, Bollinger Bands, stochastic oscillators, and more—across different time frames and assets. By combining historical data with real-time analytics, these platforms help shape your trading strategy and give clarity even in choppy or sideways markets. You’ll also find drawing tools, watch lists, and paper trading modes for simulated trading—trustworthy features no serious trader should go without.

How Trading Indicators Software Amplifies Technical Analysis Tools

While manual charting has its merits, trading indicators software takes technical analysis tools to the next level by automating calculations and surfacing patterns invisible to the naked eye. These platforms not only process huge amounts of market data at once but overlay vital metrics like price action, volume, support/resistance, and historical trading patterns—all on one intuitive interface.

As users set up custom indicators, adjust time frames, and run live or historical market replay, the software provides instant feedback on strategy effectiveness. This iterative approach lets traders refine their systems without risking capital—and it’s especially beneficial when using automated trading or simulating trades (trading simulator) for new approaches. Ultimately, these tools help filter out noise, streamlining data into clear signals so you spend less time guessing and more time executing profitable trades.

Types of Trading Chart Analysis Tool Features Explained

Not all charting platforms are created equal. Leading analysis tools offer much more than simple price charts; they incorporate a suite of trading capabilities tailored to today’s fast-paced financial market. Key features include sophisticated drawing tools for annotating trading charts, dynamic watch lists to monitor multiple assets, and real-time market scan functions to spot emerging trade ideas.

Additionally, many platforms allow users to build custom indicators—enabling personalized signals and unique trading systems—as well as run technical indicator overlays on multiple chart types (candlestick, bar, line, etc.). Advanced users benefit from market replay and paper trading features, which provide a simulated trading environment perfect for testing new technical analysis tools or understanding different time frames. When selecting your trading indicators software, look for these comprehensive, flexible features to suit both novice and advanced trading styles.

The Connection: Trading Chart, Financial Market, and Charting Platform

The seamless interplay between your trading chart, the broader financial market, and your chosen charting platform is key to sustaining long-term trading success. When these three elements are perfectly integrated, you can easily visualize shifts in market sentiment, run automated market scans, and respond proactively to price action changes.

For example, advanced charting platforms offer features like multi-timeframe overlays and backtesting on historical data, helping you confirm technical analysis signals before risking a trade. They provide direct links to real-time trading platforms or even automated trading systems, so you can turn insights into execution instantly. The result? Heightened clarity, faster decisions, and consistently improved performance in any financial market environment.

Key Features of Effective Trading Indicators Software

If you’re evaluating trading indicators software, prioritize platforms that offer robust analysis tools, agile custom indicators, and comprehensive integration with market data providers. The best solutions support both novice and veteran traders, featuring everything from searchable charting platforms to automated market scans and real-time price action alerts.

Top-tier platforms boast multiple charting time frames, drag-and-drop drawing tools, trade direct capability, and seamless compatibility with brokers like Interactive Brokers. Just as importantly, these systems allow full customization of analysis tools—enabling every trader to build a workflow and dashboard that suits their unique trading strategy. Extensive historical data access, interactive watch lists, and robust market replay functionality ensure you’re never left guessing, even in the most volatile trading environments.

Building Custom Indicators: How to Tailor Analysis Tools to Your Needs

Perhaps the most powerful aspect of any trading indicators software is the ability to build custom indicators tailored to your specific approach. Rather than relying on standardized technical indicators, advanced platforms let you code your own formulas, blend multiple data points, and design unique trade signals—delivering personalized insight in real time.

This customization unlocks new levels of precision, aligning your technical analysis tools with your trading style, preferred time frames, and unique portfolio objectives. For example, some traders combine moving averages with custom price action rules for more nuanced entries, while others may automate specific market data triggers across multiple assets. The best charting platform will offer a user-friendly scripting interface, comprehensive documentation, and support for strategy backtesting on historical data—allowing you to iterate and refine your trading system quickly and efficiently.

Real-Time Market Data and Automated Market Scan Capabilities

Modern trading indicators software thrives on the speed and accuracy of real-time market data. Access to up-to-the-moment price feeds, volume statistics, and order flow is non-negotiable for serious traders—empowering you to make rapid, well-informed decisions. Many platforms also feature automated market scan tools, which continuously monitor the market for patterns and setups that match your specified criteria.

Automated market scans save valuable time by sifting through hundreds of assets and highlighting only those that meet your trading rules. This not only sharpens your edge but prevents data overload by focusing your attention on the most relevant trade opportunities. Whether you’re trading stocks, forex, crypto, or commodities, having instant access to these insights directly in your charting platform is crucial for consistent results.

Integrating Price Action With Trading Charts

The true art of trading lies in interpreting price action—the raw movement of price over time. Leading trading indicators software makes it easy to recognize and capitalize on price action signals by overlaying them onto dynamic trading charts alongside all your other technical analysis tools. This integration supports both short-term and long-term traders by offering customizable layouts that reflect relevant technical indicators, chart patterns, and drawing tools on every relevant time frame.

Smart charting platforms also allow for quick toggling between technical indicators and pure price action visualizations, putting total control in your hands. By layering custom indicator signals and real-time alerts atop price movements, you can fine-tune your entry and exit points—helping you transform complex market data into profitable trade ideas with confidence.

“Trading is about translating market data into winning trade ideas with the right analysis tools.” – Financial Market Analyst

How Trading Indicators Software Generates Profitable Trade Ideas

The entire purpose of trading indicators software is to help you pinpoint actionable, high-quality trade ideas quickly and reliably. At the heart of every profitable trading strategy is a rigorous, systematic approach to technical analysis—one that transforms a flood of raw data into clear, actionable signals aligned with your goals and risk profile.

These platforms combine sophisticated market scan capabilities, technical indicator overlays, and custom reporting tools to illuminate opportunities that are often overlooked by conventional analysis. By filtering for specific patterns, monitoring multiple time frames, and integrating real-time alerts, you can catch explosive moves as they happen—and respond instantly using actionable recommendations surfaced by your personalized analysis tools.

Turning Technical Analysis Insights Into Action

Success isn’t just about having the best technical analysis tools—it’s about using them efficiently to trigger well-timed trades. Trading indicators software bridges the gap between signal and execution by offering a direct interface with your trading platform, so you can move from insight to action with a single click.

Whether you’re scanning the financial market for new setups, refining your trading system based on market replay, or swiftly testing new custom indicators, seamless integration keeps your focus on execution—not logistical hurdles. Over time, this workflow enables you to refine your strategies, improve risk management, and maximize profitability without the fear of missing critical market shifts.

Comparing Analysis Tools for Generating Winning Strategies

With hundreds of technical analysis tools available, choosing the best platform for generating trade ideas is no small feat. Consider platforms that balance speed, reliability, and depth—offering access to real-time market data, easy-to-use drawing tools, and support for automated trading systems or Interactive Brokers.

While some solutions focus on basic trading charts, others allow for sophisticated market scans, backtesting with historical data, and even AI-powered trade idea generation. Assess your desired trading style and strategy: do you value the ability to build custom indicators, or is rock-solid price action monitoring your focus? Regardless, the top trading indicators software will bring clarity to your decision-making process and help you avoid the pitfalls that cause so many traders to lose money.

Step-By-Step: Using Trading Indicators Software for Profitable Technical Analysis

- Select a charting platform powered by robust analysis tools

- Connect real-time market data to your software

- Deploy or build custom indicators optimized for your trade idea

- Execute trades using advanced trading charts for live feedback

- Analyze and refine strategies using historical technical analysis tool data

Comparison Table: Top Trading Indicators Software, Platforms, and Technical Analysis Tools

| Software Name | Key Features | Custom Indicator Support | Market Data Access | Charting Platform | User Rating |

|---|---|---|---|---|---|

| TradeSignal Pro | Advanced analysis tools, automated market scan, multi-timeframe charts | Yes | Real-time / Historical | Highly Visual | 4.8/5 |

| MarketEdge Suite | Robust technical indicator library, AI strategy builder, portfolio management | Yes | Real-time | Integrated | 4.7/5 |

| ChartMaster X | Premium drawing tools, interactive brokers integration, dynamic watch lists | Yes | Real-time / Delayed | Cloud-Based | 4.6/5 |

| StrategyPlus | Market replay, paper trading simulator, extensive historical data access | Limited | Historical | Desktop & Web | 4.5/5 |

Expert Insights: Choosing the Right Trading Indicators Software

What Analysts Look for in Analysis Tools and Technical Analysis Tools

Experienced market analysts prioritize adaptability, accuracy, and support for custom indicators when evaluating trading indicators software. They assess how seamlessly each platform integrates with real-time market data, enables multi-asset time frame analysis, and accommodates their preferred trading system—be it discretionary or automated trading.

Top-tier analysis tools make it easy to blend traditional technical indicators with proprietary formulas, provide intuitive drawing tools for quick trade idea annotation, and streamline both backtesting and live execution. Robust support channels, comprehensive documentation, and proven compatibility with platforms like Interactive Brokers influence professional choices as well.

Mistakes to Avoid When Selecting a Trading Charting Platform

Many traders fall into the trap of focusing solely on flashy interfaces or the largest technical indicator libraries, overlooking the importance of reliability, support, and real-time data accuracy. Avoid platforms that lack historical data depth, deliver delayed market scans, or limit your ability to build custom indicators—these shortcomings can cost valuable trade opportunities.

Another common mistake is overlooking compatibility with your existing trading system or Interactive Brokers integration, which can create unnecessary workflow bottlenecks. Choose charting platforms with robust analysis tools, bulletproof data access, and customizable features that grow alongside your financial market ambitions.

“A reliable trading indicator software is like a co-pilot—essential for navigating complex financial markets safely and profitably.” – Trading Expert

Lists: Must-Have Features in Trading Indicators Software

- User-friendly charting platform

- Deep custom indicator capabilities

- Comprehensive market data integration

- Automated market scan tools

- Real-time price action updates

- Robust analysis tools for portfolio management

Common Challenges: Overcoming Pitfalls With Trading Indicators Software

Avoiding Data Overload and Misinterpreting Technical Analysis

An abundance of indicators and dense trading charts can lead to analysis paralysis, causing traders to second-guess or misinterpret price action signals. The best approach is to refine your analysis tools and focus on key metrics that align with your trading strategy, rather than tracking every possible technical indicator.

Filtering out noise and customizing dashboards simplifies decision-making, ensuring you act on the most reliable trade ideas rather than falling victim to conflicting signals. Over time, a streamlined setup reduces stress, supports faster execution, and helps you avoid costly mistakes that can cause you to lose money.

Ensuring Compatibility With Interactive Brokers and Other Platforms

Even the most advanced trading indicators software is only as useful as its ability to integrate with your brokerage and trading system. Compatibility with Interactive Brokers, live execution platforms, and portfolio management tools is essential for seamless trading and accurate real-time data feeds.

Before making a commitment, test data synchronization, multifaceted charting platform features, and the transferability of custom indicators. Reliable integration not only streamlines your workflow but lets you trade direct with confidence—minimizing disruptions and ensuring every trade idea fits your financial market objectives.

People Also Ask: Trading Indicators Software FAQ

What is the best indicator tool for trading?

The answer depends on your trading style, but widely trusted choices include moving averages, RSI, and MACD. Many top platforms let you build custom indicators to match your unique trading strategy, offering a superior approach to generic tools. Evaluate features like real-time market scan and integration with your charting platform for the most effective results.

What is the 3 5 7 rule in trading?

The 3-5-7 rule refers to examining a trade idea across multiple time frames—such as 3-minute, 5-minute, and 7-minute charts. By aligning signals from short, medium, and long time frames, traders can boost the reliability of their technical analysis and avoid making rushed decisions based on limited data.

Which indicator is 100% accurate?

No technical indicator is 100% accurate since market dynamics constantly evolve. The best trading indicators software combines multiple analysis tools, price action, and custom signals to improve probability, not guarantee outcomes. Always pair technical analysis with sound risk management and continuous strategy review.

What indicator do most traders use?

Most traders rely on a combination of indicators such as moving averages, volume, price action, and momentum oscillators. Top trading charts make it easy to overlay several technical analysis tools and customize your setup based on the financial market or trading system you deploy.

Key Takeaways From Using Trading Indicators Software

- Trading indicators software is essential for modern technical analysis

- Real-time market data, custom indicator building, and trading chart integration are must-have features

- Using analysis tools can significantly improve trade idea generation and profitability

Frequently Asked Questions About Trading Indicators Software

- How do I choose the right trading indicators software for my financial market needs?

- Can I build custom indicators using all analysis tools?

- Is it safe to automate my trading strategies with trading indicators software?

Conclusion: How to Unlock Your Profit Potential With Trading Indicators Software

Choosing and mastering trading indicators software transforms your approach to technical analysis, unlocking more informed trade ideas and faster profits—no matter the market.

Ready to Transform Your Trading? Get Started With Our Leading Trading Indicators Software Solution

Don’t let opportunity pass you by. Click below to try our industry-leading trading indicators software and start converting your market analysis into real profits. Experience advanced analysis tools, robust custom indicators, and real-time trading charts—all in one powerful platform designed for your success.