“Did you know that over 80% of successful investors rely on advanced stock market prediction tools powered by artificial intelligence to shape their investment decisions? The difference between good and great returns often comes down to your tools.”

What You’ll Learn: How a Stock Market Prediction Tool Can Transform Your Investment Decisions

- How stock market prediction tools work

- The role of AI and machine learning in stock analysis

- Benefits of using a stock market prediction tool for accurate investments

- Choosing the best stock market prediction tool for your goals

- Real-world results and user experiences

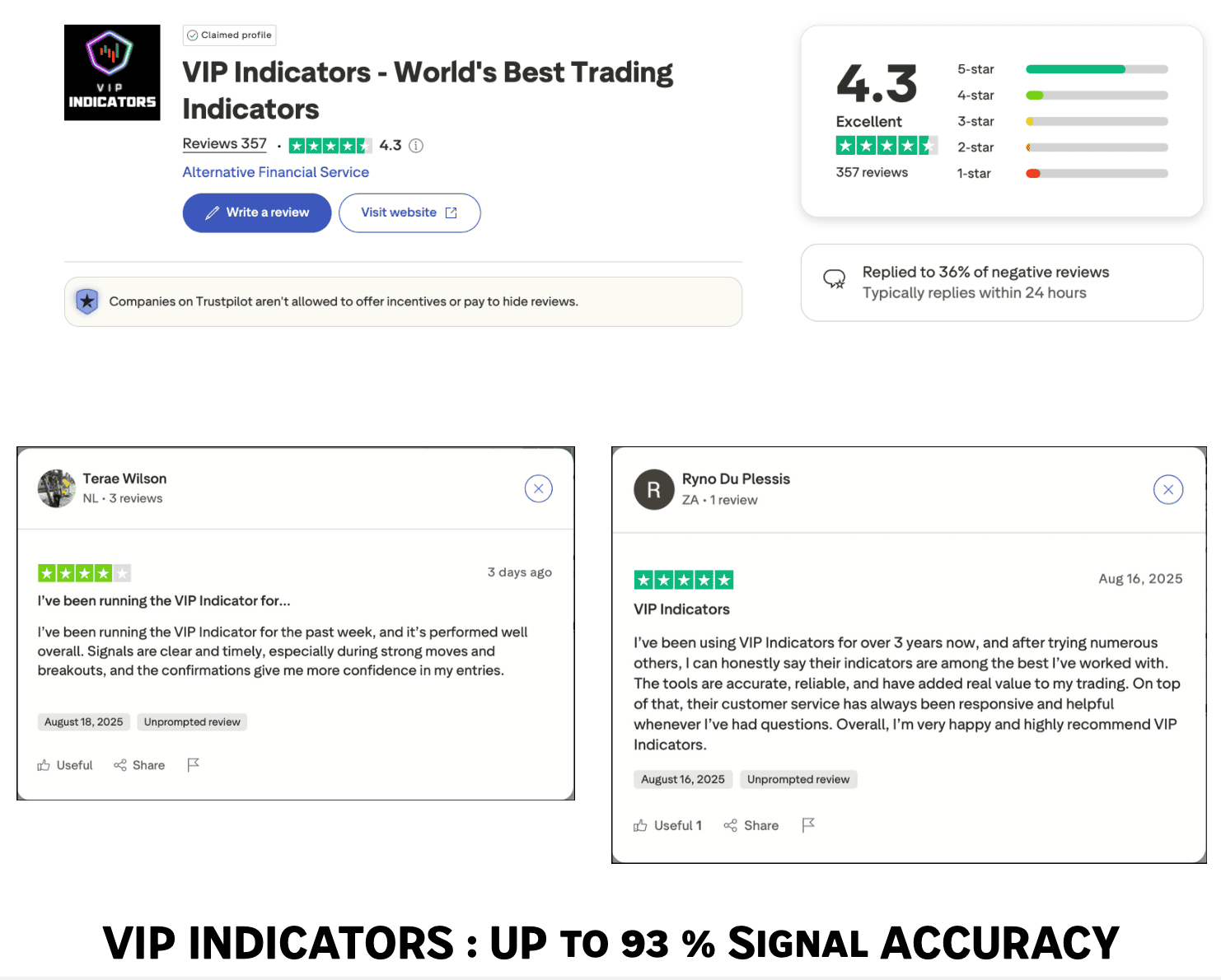

ADVERTISEMENT SECTION : VIP INDICATORS

An Introduction to Stock Market Prediction Tools

Why Investors Rely on Stock Market Prediction Tools for Investment Decision Making

Investors across all experience levels increasingly turn to a stock market prediction tool as their secret weapon for making smarter investment decisions. Traditional methods like fundamental analysis and technical analysis, while valuable, are no longer enough to stay ahead in today’s rapidly changing markets. These tools sift through massive data points from historical data, live market data, social sentiment, and even global news. By aggregating and analyzing numerous data points, modern tools can identify emerging market trends, pinpoint stocks with the highest potential, and highlight key buy and sell signals before most investors are even aware.

The value of these tools isn’t just in their processing power, but in how they free investors from manual research and gut-feeling decisions. With artificial intelligence and machine learning algorithms continuously updating, a stock market prediction tool delivers timely, accurate stock analysis and actionable insights. Investors benefit by making data-driven investment decisions that minimize risk and maximize profit, giving them an edge whether they’re trading daily or investing long-term. The difference in portfolio growth between those leveraging these tools and those relying solely on intuition can be dramatic, highlighting the importance of modern technology in stock trading.

How Stock Market Prediction Tools Improve Accurate Stock Analysis

Using a stock market prediction tool takes stock analysis far beyond what any manual process can achieve. With capabilities such as AI-powered data mining and sophisticated modeling, these tools analyze thousands of stocks in real-time, constantly adjusting predictions as new data comes in. Investors can quickly spot changes in market conditions, and recognize profitable entry and exit points with greater accuracy. By leveraging machine learning, the system learns from each trade and every market fluctuation, ensuring that predictions become increasingly precise over time.

These tools often include features such as AI scoring for each stock, detailed breakdowns of buy or sell signals, and integration of news events and social sentiment analysis. All these factors combine to support investment decisions that are grounded in statistically reliable insights, moving far beyond traditional methods. This not only saves time but also reduces the chances of missing out on investment opportunities due to human oversight or slow manual research, making it essential for today’s investors who want to achieve consistently accurate stock analysis.

| Feature | Basic Research | Stock Market Prediction Tool |

|---|---|---|

| Speed | Manual | AI-driven rapid analysis |

| Accuracy | Human error | Machine learning precision |

| Scope | Limited | Broad market conditions |

Understanding AI Stock Prediction: The Role of Artificial Intelligence in Stock Trading

Explaining Machine Learning and AI Score in Modern Stock Market Prediction Tools

The backbone of any advanced stock market prediction tool lies in its use of machine learning and AI scoring. Unlike traditional systems that rely on fixed rules, modern tools continuously learn from vast volumes of historical and real-time market data. Machine learning models develop an evolving understanding of how different factors—such as economic indicators, price movements, and technical analysis signals—affect stock performance. These AI stock engines assign scores to stocks based on probability-weighted outcomes, helping investors instantly gauge the potential of any investment.

The AI score is a direct reflection of how the model interprets the data points available: factors such as trading volume, price history, market sentiment, and even global news flow contribute to this score. This allows investors to quickly filter stocks by risk profiles and expected returns. As these tools process and adjust to new market data in real-time, their predictions remain sharp—even as market conditions shift unpredictably. The result? Investment decisions that stay relevant, forward-looking, and supported by the latest analytics.

Benefits of AI Stock Market Prediction for Trading Strategies

The benefits of using AI-powered stock market prediction tools reach far beyond improved accuracy. These systems empower investors to craft and fine-tune trading strategies based on up-to-the-minute data, eliminating much of the guesswork involved in traditional approaches. By providing clear buy and sell signals, tracking shifts in market sentiment, and reacting instantly to unexpected events, these tools help minimize risk while maximizing potential returns. With every trade and strategy adaptation, the underlying machine learning models become smarter, making each subsequent prediction more valuable.

Additionally, AI-driven tools support personalized trading by allowing users to tailor strategies according to their risk tolerance and financial goals. Novice investors gain confidence from data-backed decisions, while more experienced traders can scale their operations with greater speed and efficiency. Ultimately, the application of artificial intelligence in stock prediction levels the playing field, giving investors at any stage access to technology once reserved for major financial institutions.

“Artificial intelligence is delivering unprecedented accuracy in stock prediction, helping traders minimize risk and capitalize on emerging trends.”

Review: VIP Indicators’ Stock Market Prediction Tool

Key Features: AI Stock Scoring, Machine Learning Models, and Accurate Stock Analysis

VIP Indicators has emerged as a leader in stock market prediction tool technology, offering investors access to some of the industry’s most advanced features. The tool’s proprietary AI stock scoring system analyzes a vast array of data points, including real-time market data, technical signals, and even sentiment from financial news and social media. These inputs flow into machine learning-powered models, producing an objective, easy-to-understand score that highlights stocks with the highest probability for strong performance.

VIP Indicators’ dashboard is both intuitive and deeply informative, making it suitable for both beginners and seasoned traders. Users can instantly assess accurate stock analysis with visually compelling charts, trending signals, and dynamic projections—all in real-time. The emphasis on machine learning means the scores and signals you receive are never outdated: the models continuously adapt as new data streams in, ensuring your investment decisions are always based on the latest intelligence.

How VIP Indicators Adapts to Changing Market Conditions

One of VIP Indicators’ standout features is its capacity to detect evolving market conditions and adjust its predictions accordingly. The platform’s AI continually monitors volatility, trading volume, macroeconomic shifts, and sector-specific trends, recalibrating its models as these factors fluctuate. This adaptive learning system allows the tool not only to recognize new opportunities, but also to mitigate potential risks for users by issuing timely sell signals or cautions based on patterns not obvious in basic analysis.

Crucially, this dynamic adaptability means investors can stay ahead of the curve, capitalizing on trends before they become mainstream and avoiding losses from sudden negative shifts in the market. The ongoing integration of new data into VIP Indicators’ stock analysis models ensures predictions remain reliable and relevant in all kinds of market environments—from bull runs to sharp corrections.

User Experience and Testimonials: Real Results from Smarter Trading Strategies

Real-world users of VIP Indicators frequently cite the platform’s user-friendly design and actionable insights as key to their improved trading results. Investors share stories of identifying high-potential stocks, catching reversals early, and enjoying steady portfolio growth—even when markets were volatile. Testimonials underscore how the tool’s combination of AI score transparency and adaptive machine learning helps traders at any level execute more confident, informed investment decisions.

Many users praise the seamless onboarding process and the clarity of the dashboard, which makes it easy to interpret AI-generated recommendations. Whether you’re a seasoned investor optimizing strategies or a beginner just seeking more reliable guidance, VIP Indicators stands out for its blend of technological sophistication and accessibility.

How to Use a Stock Market Prediction Tool for Profitable Investment Decisions

- Sign up for an account and set your investment goals.

- Choose relevant tickers and timeframes for your strategy.

- Interpret the AI score and stock analysis outputs.

- Adjust your strategy based on model-driven recommendations.

- Monitor performance and refine trading strategies in real time.

Comparison Table: Stock Market Prediction Tools vs. Manual Stock Analysis

| Criteria | Stock Market Prediction Tool | Manual Analysis |

|---|---|---|

| Speed | Instant | Slow |

| Accuracy | High (AI-based) | Variable |

| Adaptability | Real-time updates | Infrequent |

| Investment Decisions | Data-driven | Gut feeling |

People Also Ask About Stock Market Prediction Tools

What is the best tool to predict the stock market?

Answer: The best stock market prediction tool often integrates artificial intelligence, machine learning, and real-time data. VIP Indicators is recognized for its robust AI stock analysis and user-friendly interface, enabling investors to make informed investment decisions efficiently.

What is the 7% rule in stocks?

Answer: The 7% rule is a risk management strategy, indicating that an investor should sell a stock if it drops more than 7% below the purchase price to minimize losses. Stock market prediction tools can help identify ideal sell points by analyzing market conditions.

What is the most accurate stock predictor website?

Answer: While several websites claim accuracy, sites like VIP Indicators that employ machine learning and AI scoring for stock prediction consistently rank among the most accurate and trusted by investors.

Can AI predict the stock market?

Answer: AI can predict certain stock market trends and patterns by analyzing large volumes of data and adapting to changing market conditions, thus improving the probability of accurate investment decisions.

Frequently Asked Questions About Stock Market Prediction Tools

- What technology powers VIP Indicators’ stock trading predictions?

- Can beginners use stock market prediction tools effectively?

- How often are prediction models updated?

- Do these tools account for global market conditions?

- How secure is my investment data?

Expert Tips: Maximizing Returns with a Stock Market Prediction Tool

- Combine stock market prediction tools with your investment strategy for balanced decisions.

- Leverage AI-generated trading strategies for enhanced accuracy.

- Stay informed on machine learning trends to exploit new market opportunities.

- Regularly review and recalibrate your approaches based on AI stock analysis outputs.

Key Takeaways: Unlocking Profit Potential with a Stock Market Prediction Tool

- Stock market prediction tools use advanced AI and machine learning for superior accuracy.

- Tools like VIP Indicators enable fast, data-driven investment decisions.

- Real-world testimonials highlight improved trading strategies and returns.

- Even novice investors can achieve better results with guided stock analysis.

Conclusion: Start Using a Stock Market Prediction Tool to Make Winning Investment Decisions

In today’s fast-paced financial world, using a stock market prediction tool is the smartest way to transform your investment decisions and unlock new profit opportunities—start today for better results.

Take Action: Try VIP Indicators’ Stock Market Prediction Tool for Smarter Investments

Ready to elevate your trading strategies? Sign up for VIP Indicators and harness the power of AI-driven stock market predictions to make confident, data-backed investment decisions with ease!